As you approach your retirement years, understanding how to minimize RMD taxes becomes crucial for preserving your financial well-being. Required Minimum Distributions (RMDs) can significantly impact your retirement strategy and tax planning. In this post, we’ll explain what RMDs are, who they affect, and explore 5 strategies to minimize RMD taxes to help reduce the potential tax burden that comes with them.

What are Required Minimum Distributions (RMDs)?

RMDs are mandatory withdrawals you are required to start taking from your retirement accounts once you reach a certain age. Think of it as the IRS’s way of ensuring that you eventually pay taxes on the money you’ve saved in your tax-deferred retirement accounts. The amount you need to withdraw each year is calculated by dividing your account balance (as of December 31 of the previous year) by a life expectancy factor provided by the IRS.

However, RMDs aren’t just another line item on your to-do list; they are a critical aspect of retirement income planning. Whether you are aware of it or not, the timing, size, and frequency of your RMDs can drastically impact your tax situation. Without careful planning, they may push you into a higher tax bracket or complicate other aspects of your retirement, such as Medicare premiums or Social Security taxation.

Who do RMDs Impact?

RMDs affect anyone with traditional retirement accounts, such as Traditional IRAs, 401(k)s, 403(b)s, and other tax-deferred retirement plans. You must start taking RMDs at age 73 (or age 72 if you turned 72 before January 1, 2023, or age 70½ if you turned 70½ before January 1, 2020). Roth IRAs remain exempt from RMDs during the original owner’s lifetime, making them valuable for long-term tax planning. Roth IRAs are an exception—no RMDs are required during the original account owner’s lifetime, which makes them an attractive option for long-term tax planning.

Furthermore, for those who have inherited accounts, the SECURE Act introduced new rules, including the “10-year rule,” which requires non-eligible beneficiaries to withdraw the entire balance within ten years following the account holder’s death. This can create unique tax challenges for heirs and may call for specific estate planning strategies.

When Should You Take Your First RMD?

The timing of your first RMD is crucial because taking it too late could result in steep penalties, while taking it too early could impact your tax bracket. Generally, you must start at age 73 for most individuals, as of the changes introduced by the SECURE Act 2.0 in 2022. This applies to tax-deferred retirement accounts such as traditional IRAs, 401(k)s, and similar plans. If you were born between 1951 and 1959, your RMDs start at age 73. If you were born in 1960 or later, RMDs must begin at age 75.

For your first RMD, you have the option to delay taking it until April 1 of the year following the year you turn 73. However, this April 1 deadline only applies to your first RMD; all subsequent RMDs must be taken by December 31 of each year.

While deferring your first RMD until the following year may seem convenient, it could result in having to take two RMDs in that same year—one for the year you turned 73 and another for the current year. Depending on your financial situation, taking two RMDs in one year might push you into a higher tax bracket, increasing your overall tax liability. This is why it’s important to evaluate your tax situation before deciding when to take your first distribution.

For some, spreading RMDs across two tax years may offer better control over your taxable income. Discussing this with a fee-only financial advisor can help ensure you choose the best timing to minimize RMD taxes and avoid unnecessary penalties.

How to Calculate Your RMD

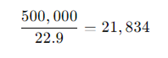

Calculating your RMD is straightforward but requires attention to detail. The IRS provides a Uniform Lifetime Table to determine how much you need to withdraw. The formula to calculate your RMD is:

![]()

The life expectancy factor, or distribution period, is based on your age and can be found on the IRS’s Uniform Lifetime Table. For instance, if you’re 75 years old, the distribution period factor is approximately 22.9. If your IRA balance as of December 31 is $500,000, your RMD would be:

This means you must withdraw at least $21,834 for the year. Keep in mind that you can always withdraw more than your RMD, but the excess does not count toward future RMDs.

There are other considerations when calculating your RMD, such as whether your spouse is more than 10 years younger than you and is your sole beneficiary. In that case, you would use the IRS’s Joint Life and Last Survivor Expectancy Table, which could lower your RMD.

What Types of Retirement Accounts Are Subject to RMDs?

Not all retirement accounts are subject to RMDs, and knowing which accounts require them can help with your tax planning. The most common types of accounts that are subject to RMDs include:

- Traditional IRAs: These include SEP IRAs and SIMPLE IRAs.

- 401(k) Plans: Employer-sponsored retirement plans like 401(k)s, 403(b)s, and 457(b)s are subject to RMDs.

- Rollover IRAs: Once you’ve rolled over funds from a 401(k) or another retirement plan into an IRA, those funds are subject to the same RMD rules as a Traditional IRA.

- Inherited IRAs and 401(k)s: Beneficiaries of inherited retirement accounts must also take RMDs, but the rules vary depending on the relationship between the beneficiary and the account holder, as well as when the account holder passed away. Non-spousal beneficiaries often must withdraw the entire balance within ten years under the SECURE Act’s 10-year rule.

It’s worth noting that Roth IRAs do not require RMDs during the original account owner’s lifetime, but beneficiaries of inherited Roth IRAs are subject to RMD rules. This makes Roth IRAs an attractive option for those who want to avoid RMDs while they are alive and leave a tax-efficient inheritance to their beneficiaries. By understanding which of your accounts are subject to RMDs, you can plan better for taxes, withdrawals, and other financial goals during your retirement years.

What are the Tax Implications of RMDs?

When you take an RMD, the amount you withdraw is generally subject to ordinary income tax. This can affect not only the RMD itself but also your broader financial picture. RMDs could push you into a higher tax bracket, thereby increasing your tax bill for the year. The consequences extend beyond income taxes: they can also affect your Medicare premiums and the taxation of Social Security benefits.

Failing to take your RMD on time comes with a hefty penalty—50% of the amount you were supposed to withdraw but didn’t. This makes it crucial to stay on top of these requirements to avoid unnecessary extra costs. By being proactive and implementing thoughtful tax strategies, you can minimize RMD taxes.

Read More: Required Minimum Distribution (RMD) Facts

5 Effective Strategies to Minimize RMD Taxes

If you’re looking to reduce the tax burden of your required minimum distributions (RMDs), consider these 5 strategies to minimize RMD taxes. From making a Qualified Charitable Distribution (QCD) to exploring Roth IRA conversions, these methods can help you strategically manage your withdrawals and lower your taxable income during retirement.

1. Qualified Charitable Distribution (QCD)

If you’re 70½ or older, you can transfer up to $100,000 per year directly from your IRA to a qualified charity. This amount counts toward your RMD but is not included in your taxable income, which can lower your tax bill. The QCD is a powerful option for those who are charitably inclined and want to reduce their taxable income, especially in years when other sources of income may push you into higher tax brackets. Moreover, a QCD doesn’t affect your adjusted gross income (AGI), which can help in managing other aspects of your tax situation.

2. Use the “Still-Working Exception”

If you are still employed and participating in your company’s 401(k), you might be able to delay RMDs from that account until you retire. This is known as the “still-working exception” and only applies to the 401(k) associated with your current employer. This can be a valuable tool to manage taxable income during your working years. However, this rule does not apply to IRAs or those who own more than 5% of the company.

3. Consider a Qualified Longevity Annuity Contract (QLAC)

A QLAC is a special type of deferred annuity that allows you to fund the contract with up to 25% of your IRA or 401(k) balance (up to $145,000 as of 2023). This amount is excluded from your RMD calculation, thereby lowering the amount of required distributions. You can defer QLAC payouts until age 85, which can help reduce your taxable income in earlier retirement years and provide a stream of income later in life. This option may appeal to those looking for a way to reduce RMDs and ensure they don’t outlive their savings.

4. Convert to a Roth IRA

Converting a traditional IRA or 401(k) to a Roth IRA can be a strategic way to minimize future RMDs, as Roth IRAs are not subject to RMD rules during the original account owner’s lifetime. Although the conversion is a taxable event, spreading out the conversion over several years can help avoid jumping into a higher tax bracket. A Roth IRA offers the added benefit of tax-free growth and withdrawals in retirement, making it a flexible option for long-term tax planning.

5. RMD Planning Checklist

To ensure you’re making informed decisions, consider downloading our free RMD Planning Checklist. This comprehensive guide helps you evaluate critical factors, such as:

- Is your RMD more than you need for living expenses? If so, consider transferring your RMD to a non-qualified account for reinvestment rather than leaving it idle in cash.

- Are market conditions affecting your account balance? If the market is significantly up or down, you might want to adjust your withdrawal timing to lock in gains or avoid selling at a loss.

- Do you have an inherited retirement account? Be mindful of the unique RMD rules introduced by the SECURE Act, such as the 10-year withdrawal requirement for non-eligible designated beneficiaries.

This checklist also reminds you to review your tax withholding strategy and ensure it’s in line with your current tax liabilities. It can be particularly helpful if you’ve recognized large amounts of taxable portfolio income this year, as you may want to earmark your RMD to cover any tax shortfalls.

Read More: 5 Items You Can’t Afford to Overlook When Planning for Retirement

How to Minimize RMD Taxes

Beyond these 5 strategies to minimize RMD taxes, it’s important to evaluate your entire tax situation annually. For example, if you have excess taxable income from other sources, earmarking a portion of your RMD for tax withholding can help manage your tax liability. Also, in years where capital gains or dividends are higher than expected, using RMDs to offset quarterly tax payment shortfalls can be a smart move.

Managing RMDs is a vital part of any comprehensive retirement strategy. By understanding how these distributions work and implementing strategies on how to minimize your RMD taxes, you can keep more of your hard-earned savings. Whether through charitable giving, strategic Roth conversions, or leveraging the still-working exception, there are multiple avenues to explore that can help you reduce the impact of RMD taxes. Navigating the complexities of RMDs and tax planning requires careful consideration, but with the right approach, you can protect your wealth and secure a more comfortable retirement.

If you’d like more information or personal guidance, please contact our team of Certified Financial Planner® (CFP®) professionals at 631-218-0077 or at info@rwroge.com. You can also send us a message directly.

R.W. Rogé & Company, Inc. is an independent, fee-only financial planning and investment management firm serving clients locally and virtually across the country, with Long Island, New York, Beverly, Massachusetts, and Naples, Florida office locations. R.W. Rogé & Company, Inc. was founded on a “client first” culture and proudly commits to acting in your best interest as a fiduciary. We have helped clients Plan, Achieve, and Live® the life they want since 1986. To learn more about how we do this, as well as our process, explore our detailed overview of services and approach.