Fourth Quarter and 2015 Review

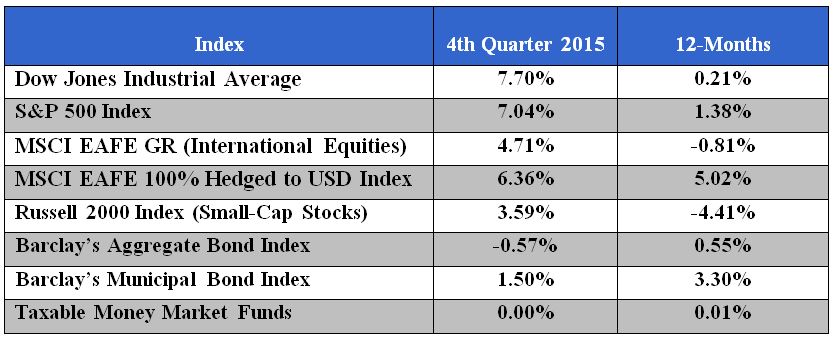

The stock market rallied during the fourth quarter to eliminate most of the losses acquired during the year and propping up returns going into year-end. This allowed the S&P 500 to take out a small gain of about 1% (with dividends) for the year. This anemic return was driven by a handful of stocks in the S&P 500 which is a composite weighted index. To highlight this, an equally weighted S&P 500 index returned -2% for 2015. Over 80% of stocks in the S&P 500 were down for the year.

Smaller company and international stocks both fared poorly with returns for the year of -4.50% and -1.00% respectively. One bright spot was international stocks based in local currency (or U.S. Dollar Hedged). Currency hedged international stocks were up over 5.00% for the year, while the unhedged international stocks were down about 1%. The difference in return between both international indexes is due to the U.S. Dollars relative strength compared to international currencies.

In the fixed income market, safe haven assets such as U.S. Treasury bonds fared well as interest rates stayed low throughout the year. The Barclays Aggregate Bond index which is heavily weighted in Treasuries gained 0.48%. Municipal bonds continued to improve, returning about 3.00% on the year as investors sought tax-free income. Investors ran away from high-yield bonds as weak oil prices affected the industry, and all industrial industries tied to it. The High Yield index lost around 4.00% for the year.

Money Markets are still paying close to zero percent, while inflation rates are trending at around 1% in the U.S. for the third quarter and close to 0% for this year.

Major Market Indexes

Outlook and Strategy

With the slowdown in China’s economy creating market volatility, as well as the political saber rattling and terrorist attacks around the world, it’s difficult for most of us to remain positive.

China’s economic growth is slowing and is forecast to grow its GDP more than 6% in 2016. The U.S. exports very little and imports quite a bit from China. The strength of the U.S. Dollar is weakening the China Yuan which helps U.S. consumers by lowering commodity costs to the U.S. and European consumers. China’s economy is not collapsing; it is going through a transition from a manufacturing based economy to a services based economy. Many older economies have gone through this same transition throughout history, including the U.S.

In the U.S. the consensus forecast is for continued GDP growth of 2.5% in 2016. In the private sector which represents about 85% of the U.S. economy, we are growing at a very nice 3.4% rate over the past two years. Automobile sales are at a record pace, and lower gasoline prices will be around for a while, acting like a temporary tax cut and further stimulating the economy.

Disposable personal income growth in the U.S. is accelerating, up 3.9% this year, unemployment is down, new home starts are increasing, and consumer balance sheets have improved. Meanwhile monetary policy is becoming slightly restrictive but is years away from becoming too restrictive. We have a lot of positives going for us that are unfortunately being lost in the media heat of the moment. That said, we are closely monitoring the divergence in stock prices. While global economic growth remains low but stable, revenue growth from reporting companies has been somewhat uninspiring. Many expected a decline in oil prices to be a big boon for the U.S. consumer, but this hasn’t happened yet. Retail stocks – which much of the discretionary spending typically goes to – has also been hurt.

Low interest rates and easy credit contributed to the U.S. oil shale boom. As investors looked for higher interest in their bond portfolio they gravitated toward high yielding bonds, a lot of which were in the energy sector. Many of these bonds will have to be restructured because oil companies can’t support the debt load at oil prices under $35 a barrel. In 2014 the energy sector represented about 10% of the U.S. economy. Today it represents less than 7%.

Emerging Market economies are highly dependent on commodity based revenue. They are also affected by the prolonged downturn in commodity prices and demand. Many Emerging Markets have U.S. Dollar denominated bonds outstanding. As the U.S. Dollar appreciated, their debt servicing payments also increased. In addition, as commodities continue to decline, their revenue to service this debt decreases.

For some historical perspective, 2016 is an election year. Election years usually have a higher probability for positive stock market returns. According to The Stock Trader’s Almanac for 2016, election years from 1833 (Andrew Jackson in case you were wondering) the presidential election year produced an average stock market return of 5.8% with 30 positive years and 15 negative years. While we don’t put much weight into such data, it’s always fun to see what the odds are for the market during an election cycle.

We continue to remain cautious with our investment strategy going into 2016. With revenue growth prospects threatened by the energy, commodities and emerging market sectors, we are starting off the New Year with almost 12% cash (3% to 4% is normal) in our portfolios, and will wait for opportunities to arise to redeploy these assets.

If you would like to speak with a Senior Wealth Advisor at R.W. Rogé & Company, Inc., please contact us at 631.218.0077. It would be our privilege to serve you and your family’s needs.