By: Ronald W. Rogé, MS, CFP®

Chairman & CEO

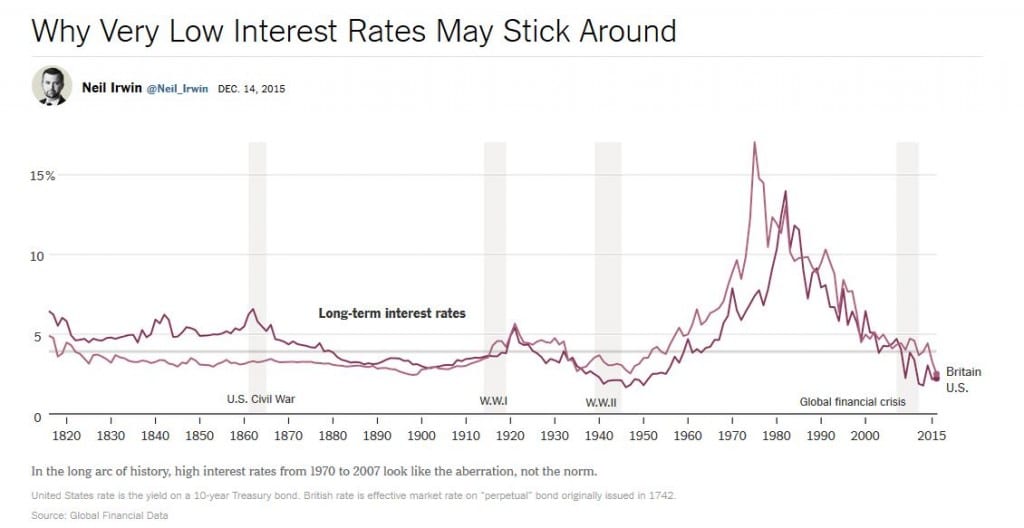

The Federal Reserve will most likely raise short term interest rates tomorrow 0.25%. While we don’t think this will have an immediate impact on the economy, the big question is how far they will go and what period of time that will take. To help answer this question the New York Times recently published an interesting chart (see below) showing the history of U.S. and U.K. interest rates from 1810 to the present.

The chart shows that long-term interest rates have historically been relatively low, clustering in the 4% to 5% range. However the period between 1970 and 2007 saw perhaps an aberration with an average rate of 7.3%. I believe those rates were driven by the demand for mortgages and the low credit check hurdle to acquire a mortgage.

Perhaps we are returning to a more normal period where rates, which historically have persisted for decades, remained below 5%. With the current 10 year U.S. Treasury yielding 2.26% the Federal Reserve over-time could manage to get long term rates to the 4% to 5% range at most. Therefore, we are looking at a possible 2% rise in rates over several years. Globally there is excess labor available, excess oil, and labor-saving technology that is being introduced at an exponential pace. This all leads to deflationary pressures that are still present in the global economy. As long as these deflationary pressures persist, interest rates will most likely remain low (below 5%).

The classical move when shifting from a declining interest rate environment lasting decades to a rising rate environment – which can also persist for decades – is to reduce fixed income assets (Bonds), which have had a tail wind of decreasing rates, to money market funds, which benefit from increasing rates. However, that’s easier to do when money markets are paying interest rates much higher than the 0% to 0.25% they are yielding today.

For several months now we have had a 10% cash allocation (money markets) in our portfolios. Our normal allocation would be in the 3% to 4% range. This is mostly due to rebalancing the portfolios and our decision to keep that money in cash until the Federal Reserve raises rates. This money is now waiting for opportunities to appear before we put it back to work.

If you have questions about planning your financial future, please feel free to contact R.W. Rogé & Company, Inc. and ask to speak with one of our professional Senior Wealth Advisors. We can be reached at 631.218.0077.